Amazon’s market share of the U.S. e-commerce market hit %52.4 in 2019.

The retail giant not only dominates the U.S. market but also rapidly expands to the global e-commerce market. In fact, after the European online fashion giant Zalando, it was the second-fastest growing online retailer in Europe, back in 2017.

In the same year, 33.5% of U.K. online spending went through Amazon.

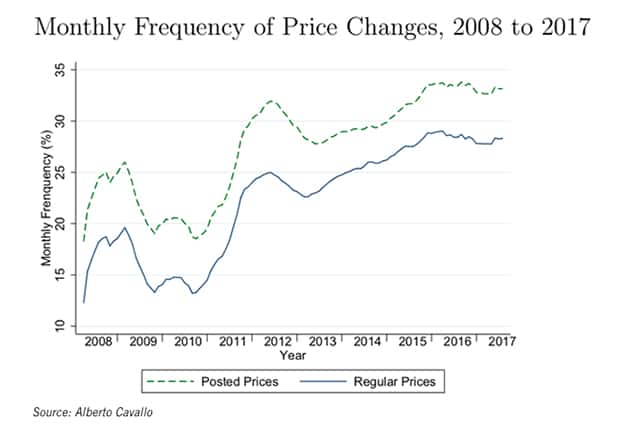

As the giant expands to the global market, it also reshapes the norms of the global retail industry. Harvard Business School professor Alberto Cavallo conducted a study on the impact of Amazon’s pricing policy on the duration of prices of other retailers. Two of his key findings illustrate the changes in retail pricing.

Firstly, before the rapid growth of the e-commerce industry, retail prices were changed every several months. His analysis illustrates the increase in the frequency of price changes.

The second interesting point he makes is that among the different retail sectors, the duration of a price is significantly reduced in the ones that Amazon had expanded.

For example, the duration of prices of the products in the ‘Food and Beverages’ category has been falling since 2015, when the giant had aggressively expanded into groceries with Amazon Fresh.

How come Amazon’s pricing strategy has a tremendous impact on others’?

Amazon’s dynamic pricing engine

Before we jump into the company’s pricing strategy, let’s have a clear understanding of what dynamic pricing means.

Dynamic pricing refers to the strategy where firms set flexible prices that change according to the conditions in the market. The factors may vary depending on the needs and objectives of a business.

In most cases, factors like

- the market average price

- how major competitors price the product

- historical sales data that includes which price point generated the most demand in the past

- current demand

- future demand forecast

- patterns in customer behavior such as when do customers buy this particular product, the frequency of their purchase, seasonal changes in their behavior

- perceived value of the product

- customers’ willingness to pay

are of vital importance to a company’s dynamic pricing strategy.

What makes Amazon’s dynamic pricing strategy superior to its competitors’?

Amazon’s pricing algorithm goes beyond human capabilities. It brings machine learning, artificial intelligence, and big data analytics into play.

As the first step, the company collects and analyzes big data, estimates future demand, and predicts future trends with the help of machine learning and AI technologies.

With the knowledge they’ve obtained from analytics, the in-house pricing engine makes millions of price changes in a day. On average, a product’s price changes every ten minutes.

Perhaps you’ve noticed that the company sells some of its products at a loss. In those cases, they cover the loss using cross-sells, up-sells, or the additional purchases of customers they’ve lured in with below-average prices.

Even if the newly converted customers don’t purchase a profitable product at first, they eventually become loyal customers because of the seamless shopping experience they enjoy.

Analyze customer behavior

An essential source of knowledge when making pricing decisions is customer behavior. Since Amazon has more data than any other retailer, the results they obtain from an analysis is far more accurate than others’.

Now, think of a world that you can define your buyer personas and accurately estimate what they will need in the future. Let’s picture that together.

Say, one of your buyer personas is C level executives of the silicon valley. Next month, Apple releases its latest iWatch, which has the most advanced hologram technology. It can visualize the files that users have on other Apple devices so that business people can work anywhere and anytime.

You’re pretty sure that your buyer persona (imaginary) is going to purchase that groundbreaking-technology product. You know that because the historical data in your hand says so. You also know the size of the target audience, again, thanks to the big data analysis.

But the question is, will they buy it from you?

Since it’s going to be a popular product, you can attract so many potential shoppers by offering a below-average price.

Based on our hypothetical consumer behavior analysis, we also know that the ‘C level’ buyer persona has a tendency to buy additional products like accessories.

You recommend iWatch accessories in various colors, and you sell them for above-average prices.

Boom! You sold so many iWatch bands and cases that the profit you’ve made on those products surpassed what you’ve made on iWatches.

That’s exactly what Amazon does, according to an analysis by Boomerang Commerce, a company founded by Guru Hariharan, a former Business Leader at Amazon.

You too must competitively price popular products since it’s the perfect way to attract a large number of customers to your store.

Learn from an illuminating mistake

Of course, even Homer nods. The company had its share of backlashes in the past.

In 2000, the giant was spotted offering different prices for the same DVDs to different customers, based on the browser they used.

The serious backlash forced CEO Jeff Bezos to make a statement:

“We’ve never tested and we never will test prices based on customer demographics.”

Amazon’s negative experience tells us something. Testing different prices on different demographic groups will annoy your customers. If you’re going to segment the market and differentiate your pricing policy, make it via personalized offers.

Benefit from psychological pricing tactics

Like any other experienced retailer, Amazon integrates psychological pricing tactics into their marketing strategy.

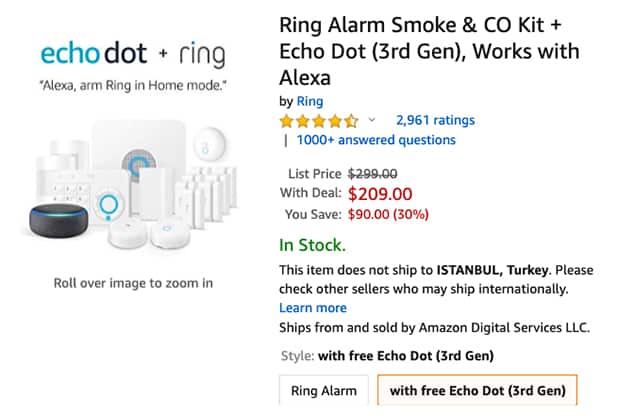

Price anchoring is one tactic Amazon applies to nearly all of its products. It’s a strategy where retailers display a higher price together with the actual one, to make the real price seem better.

The retail giant displays a ‘list price’ or ‘recommended retail price’ on almost all of its product pages.

Try anchoring if you haven’t already. Don’t forget that all retailers (online and offline) make use of this strategy at least on some of their products.

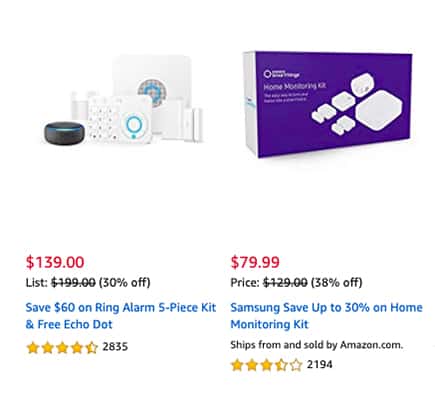

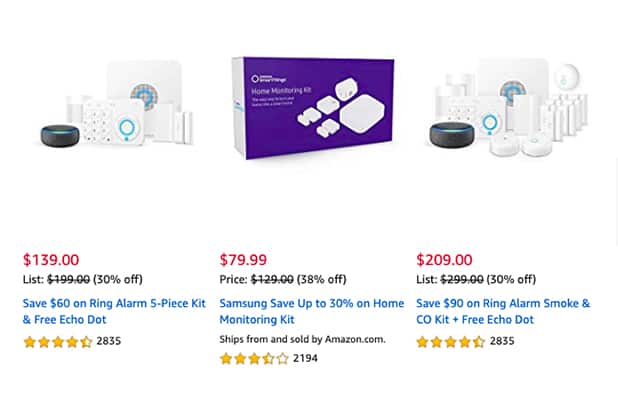

Another psychological pricing tactic the company utilizes is the decoy effect.

When you see these two products together, you have to evaluate all the product features and decide whether the difference worths $59.

However, when you see a third option, the evaluation process gets complicated.

The cheapest option is eliminated immediately because shoppers perceive it as inferior to the remaining options, and the decoy option is too expensive. Shoppers subconsciously choose the more expensive one of the original two products.

Apply the decoy pricing strategy yourself and test whether the demand for the targeted product actually changes. Take a step further and test different decoy options on the same two products, try to understand which option works best. It won’t cost you a thing, but it’ll give you an idea of how you can influence consumer behavior.

Parting words

Amazon’s pricing strategy contributed largely to its dominance in the online retail industry. The retail giant’s success all over the world continues to inspire online retailers for years.

We explained the retail giant’s pricing strategy for you, shared the lessons we took from its mistakes and talked about how you can implement its tactics yourselves.

Don’t hesitate to try out these tactics, you’ll be surprised to see the outcomes.

Frequently Asked Questions

Yes, the company has an in-house dynamic pricing engine that calculates numerous factors and dynamically adjusts its prices.

Thanks to its dynamic pricing engine, the company offers lower prices for the most popular products.

You can build an in-house pricing engine or use dynamic pricing software.

great one.

Thanks Daniel!

Thanks for sharing.

Incredible article

I`m glad to read this thank you.

Hi Kim, we're glad that you found it helpful. Thank you!

Success in business depends on a variety of factors, including skill level, effort, market factors, and much more. Thus everyone’s results in an Amazon business will differ. So no promises or claims are made as to your income potential or lack thereof. And, of course every business has some risk involved. That said, Amazon is an huge opportunity and has helped my family and I have the lifestyle and freedom we want. Maybe it can do the same for you, if you apply some effort and energy to it.

Thank you for sharing your knowledge, Jacob!